Japan’s akiya properties have been the subject of a great deal of media attention lately, whether among those seeking to escape the corporate grind in urban Japan or millennials overseas who see their dreams of property ownership slipping away with rising prices in their home country. You may have head of akiya houses in Japan selling for very cheap, and sometimes even being listed for free! But what’s the catch? Is it really free or almost free?

First, let’s look at what exactly are akiya, and do these houses live up to the hype that surrounds them?

What is an Akiya?

The word “akiya” (空き家) literally translates as an “empty house,” which may or may not have traceable ownership. Akiya are becoming an increasingly prevalent phenomenon in Japan, particularly on the smaller islands of Shikoku and Kyushu, where some prefectures see almost 20% of all housing stock lying empty.

There are a number of reasons behind why this is so, but the largest contributing factor is depopulation, particularly of the Japanese countryside. The plummeting value of these houses means that even where there are traceable owners there is little incentive for them to do much to maintain them in preparation for sale.

Akiya are more likely to be traditional properties—that is, wooden structures with clay walls, paper screens and tatami mats—but not necessarily. The problem is so entrenched that many empty and abandoned homes were only built in the last three or four decades.

Akiya Banks

Despite the name, these organizations have very little to do with banks; rather, akiya banku (空き家バンク)introduce prospective buyers of abandoned houses to those selling them (or indeed renting). These initiatives are usually driven by local authorities seeking to bring “new blood” into their regions and put a halt to what is becoming a deepening social problem.

Until such organizations were established, it was extremely difficult to find any information about akiya properties let alone how to make contact with their owners. Now, there are websites that are set up a lot like those of standard realtors. The primary difference besides the pricing and lack of an agency fee is that, since akiya banks are not enterprises and working for the public good, they may be much more forthcoming about the state the houses are in.

How do I use an akiya bank?

The first step is to find an akiya bank and sign up. Akiya and akiya banks are much more prevalent in regional towns and villages. If you have a locale in mind, it is worth doing a quick search to see whether they have a website in English (or “[place name]市 空き家バンク” in Japanese). English sites for these organizations are relatively rare, though. If you do not have a Japanese friend or mediator to help you, try searching for the housing or migration department of the local authority who may be able to provide you with direct contact information.

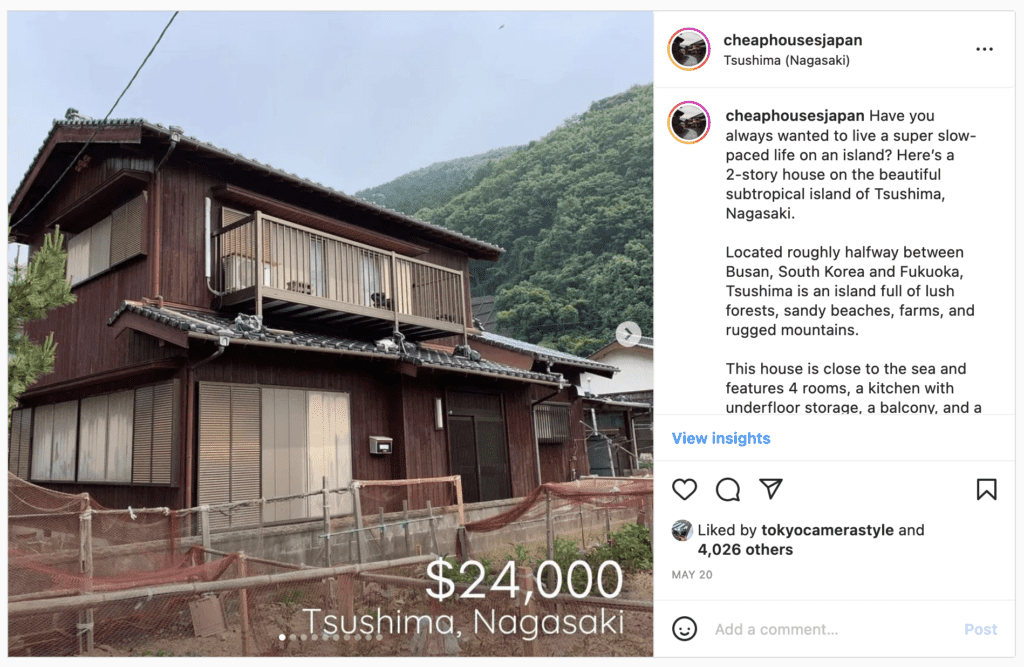

For example, the sleepy island of Tsushima in Nagasaki Prefecture has a simple website (viewed using the Google Translate browser extension) with a small section for their akiya. They are transparent about when the listing was published, whether it requires renovation, and so on, and there is a link to their contact form at the bottom of their listings. I recently featured this example in my newsletter: a 90s home with 4 rooms, a kitchen, balcony and small garden for ¥3 million (or US$24k as of late 2022).

If you are less sure regarding location, you may wish to widen your search by browsing listings at the prefectural level. For example, Nagano Prefecture has collated data for akiya banks operating across the prefecture, with a selection of empty properties for rent and for sale. You can see that this large, 112m2 5SDK home in the Togakushi area going for ¥900,000 (about US$6k) located on a national highway about 25 minutes from the bullet train, originally served as a combined store and residence. It was built in the 70s, it says, so “renovation on the whole is required.” A quick glance at the photos of the interior will confirm the need for renovations.

Much like with a real estate agent, the akiya bank will register you along with your search criteria such as location, size, price range. Anyone can sign up to an akiya bank, whether you are resident in Japan or not.

You can then book a viewing with an akiya bank representative, who will be able to answer questions and accompany you through the process up to contract signing. They may be able to provide useful advice on what funding you are eligible for to finance any necessary renovations, though this is usually limited to residents of Japan.

How much does an akiya cost?

You may be wondering, do akiya houses come cheap?

The answer is that properties vary widely. As you will see in my article on Japan’s $500 houses, some akiya homes are being given away or close to it, but I believe such properties are almost never worth the trouble; they are often (though not always) dilapidated beyond repair. It is precisely because of the large discrepancy in prices, though, that it is easy to become overwhelmed. What’s more, one akiya bank might have a different approach to another, for example, to focus on houses with greater appeal and selling potential over very run-down properties. This is why it is worth registering your interest with one of these organizations and developing a rapport with their staff—who are often very accommodating—so they can help you find a house that best meets your requirements.

Generally speaking though, Japanese akiya may be a good option for those on a budget: it is very feasible to find an excellent akiya for under $100k, and often below the $50k mark the further away from the cities you go.

Akiyas require due diligence

I have met and interviewed several foreigners for whom the property of their dreams was an unloved Japanese house in a quaint rural town that had not been lived in for a number of years, and this could be true for you too! But it takes some effort and patience—and money—to find one that does not also cause you problems that drain more of your savings than anticipated to fix at a later date.

4 Things You Should Know Before Buying An Akiya

Some akiya can be very large and still in good condition, so why are they so cheap? While there are some exceptional deals to be had in Japanese real estate (we’ll talk about that later), there are also some important pitfalls to watch out for.

Here are four things you should know before buying an Akiya in Japan.

1. Renovation Costs On Akiya Can Be Steep

The truth is many extremely cheap houses in Japan (especially under $15k USD) are in poor condition and will likely require extensive renovation work, especially if they have been empty for a long time.

Japanese houses are traditionally made of wood, so you should first check for evidence of termites or any structural damage.

Next, the plumbing and electricity may need updating to modern standards, and you’ll want to check for things like whether the property meets current earthquake resistance building standards.

Lastly, traditional Japanese style roofs (kawara roofing tiles) are prone to cracking and leaking over time if not regularly maintained. This can lead to costly water damage if not caught early.

Choosing a house with any of the above issues could result in some very costly repairs. In extreme circumstances (especially very old, run-down properties) it’s not unheard of for the completed renovation costs to equate to the cost of a much newer second hand home.

It’s certainly not all bad news though. Owning the house (rather than renting) gives you incredible freedom to do exactly what you want with the property.

Furthermore, if you are a long term resident of Japan, you may even be eligible for a government incentive scheme to subsidize home remodeling costs.

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) is offering up to one third of the cost (or max 1 million yen) to homeowners who are creating or improving their telecommuting environment (covering such things as extensions, soundproofing, and installation of partitions). It’s part of an overall government plan to diversify working styles in response to the COVID-19 pandemic. Other government assistance also exists if your renovations benefit the community (up to 200,000 yen), given that you meet the eligibility requirements (depending upon the prefecture).

2. Don't Forget About Extra Fees & Taxes

The additional one-off fees, taxes and regular taxes can be sizable when buying a home in Japan. You’ll have to pay a hefty registration tax as a one-off payment that’s applied to every property in Japan. It’s based upon the government’s evaluation criteria and in some cases can be surprisingly expensive.

Next you’ll have the property acquisition tax, based on the government appraisal of the property, and finally you’ll have all the administrative and management fees to pay as well as the usual annual property taxes.

The cost for each of these payments varies on a case by case basis but it’s worth noting that the fees alone could cost you as much as 4,000 USD.

And while these extra fees shouldn’t be a dealbreaker, they should be factored into your purchase decision and budgeting.

3. Be Careful Of Sneaky Contract Requirements Specific To Akiya

Before jumping right into purchasing an akiya, you’ll want to take a very close look at the contract and negotiate any unwanted requirements, or anything that could potentially go against your current visa. For example, some akiya contracts require that you live permanently in the house – not a great idea if you’re currently on a tourist or student visa, or plan to use the house only as a holiday home.

Next, you’ll want to make sure that the property can be bought outright since some contracts are ‘rent to own’. Meaning you would have to ‘rent’ the property for a certain number of years before the land and house ownership is eventually handed over to you some 20 years later.

Other real estate sites or akiya banks may be leasehold (as opposed to freehold). This means that only the house itself is for sale, and you would rent the land as a long term lease. This is rare, but I’ve certainly seen it in listings. Usually land rental contracts are for 20 years.

Other clauses might favor younger families, with some rent-to-own akiya contracts reducing rent by 5000 yen per month per child. This is an incentive by the local government to rejuvenate the town with a younger population, creating a market for new business, jobs and opportunities.

Other contract clauses might state that the owner must:

- Be under 43 years old

- Be a younger, married couple (quite rare)

- Have children that are in junior / high school

Fancy life as a farmer? Many rural akiya are coupled with farmland. This could be a dream for some people, but in practice designated farmland comes with many obstacles, even before purchasing.

If the land comes with farmland then you may have to get approval from the local agricultural committee (Nogyo-iinkai) and be expected to engage in full-time farming. The committee will pay regular visits to assess the land and provide information about how best to use the land. From what I have read in forums and from friends, getting farming permission and a licence can be difficult even for many native Japanese.

4. Natural Disasters Happen In Japan

Being located in the ring of fire, Japan’s geographical location makes it a prime spot for some of the largest and most common earthquakes in the world. Nowadays, Japan has some very rigorous building regulations, however that wasn’t always the case. Many older buildings in Japan are more susceptible to earthquake damage than some buyers realise.

Choosing a good location is critical. Be very careful of choosing properties that are built on reclaimed land, river banks, flood plains, reclaimed marshes or any kind of soft soil.

Many extremely cheap akiya were built before 1981, when earthquake building codes were completely different and much more lax. Experts also advise you to be careful of buying older homes that have large corner windows (a weak point in the whole structure) and large, open living areas.

That said, there are plenty of houses built before 1981 that were constructed to withstand earthquakes, so you shouldn’t let the age of house be a dealbreaker. Just something to be aware of when doing your research.

As I mentioned before, I strongly recommend hiring a qualified independent building inspector to give the property a thorough analysis. The inspection will set you back around 50,000 – 100,000 yen, but will be 100% worth it to know what you’re dealing with.

Don’t Buy A Cheap Akiya, Buy This Instead!

With all that in mind, in most cases I would strongly advise people against buying a dirt cheap akiya (ie. under $15k). Unless you’re an extreme DIYer and have many months (or even years) to dedicate to fixing up an old akiya, I absolutely wouldn’t recommend going that route.

But hold on — I don’t want to crush your dream of owning your dream house in Japan for cheap — I have an even better option that you may not have considered:

Buy a reasonable, but still cheap (by international standards) house that’s in great condition.

Because of the declining and aging population, there is a glut of excellent houses on the Japanese real estate market that don’t need much work. Some of them have even been renovated in recent years to make life easier for their residents or to make them easier to sell.

How To Find Cheap Houses In Japan That Are Incredible Value

The first step is to increase your budget a little. Trust me: this will save you a lot of money spent on repairs in the long run. In general, if you can spend more up front on the house purchase, you’ll end up with a house that is in much better condition — in fact, magnitudes better.

The second step is to sign up for my Cheap Houses Japan newsletter. I spend many hours each week sifting through literally thousands of Japanese real estate listings to find the absolute best deals under $100k — some as low as $30k or even $20k.

The houses I include in the newsletter represent excellent value: if they’re older homes, they often feature renovated modern bathrooms and kitchens, or at the very least are ready to move in.

I also scout for houses near the major cities and with good train access. For example, within 1 hour by train from Shinjuku for less than $100k. (If you’ve ever looked for houses in Tokyo, you know how difficult this is!)

In my experience, these houses often represent much better value than super cheap akiya. Especially for someone either looking for a vacation home in Japan, or a Japan resident looking to purchase their forever home.

Here are a few examples of recent homes in my newsletter:

Why did I start this newsletter? For one, I love Japanese houses. For as long as I can remember, it was my dream to own a house in Japan. After researching for years and viewing many houses, I finally pulled the trigger and bought a house a few years ago. It’s been an absolute joy to own the house, and I really want to help other people realize their dream of owning a house in Japan — one that doesn’t bankrupt them with renovation costs!

To learn more about the Cheap Houses Japan Newsletter, click the button below:

Featured image from Flickr user Boccaccio1 used with Creative Commons licence.